Crystallisation strategies

In our last Wealth post, we examined what crystallising your pension means. In this post, we explore the various methods of crystallisation – the how. There’s more than one way to crystallise a pension, and your choice of strategy can affect your tax, income, and estate planning for years. NMTVP breaks down the main crystallisation strategies people use in the UK

Crystallisation strategies

- Full crystallisation at once

- How it works: You crystallise your entire pot in one go. Typically, you take 25% as a Pension Commencement Lump Sum (PCLS) tax-free, and the rest goes into drawdown or an annuity

- Pros:

- Access a large tax-free lump sum immediately

- Simple to manage

- Clear estate planning (what’s crystallised vs uncrystallised)

- Cons:

- Could create a big tax bill if you take income too soon

- Reduces future tax-free cash growth (because future growth is now on crystallised funds)

- May trigger the Money Purchase Annual Allowance (MPAA) if you start withdrawals. This means a reduction from £60,000 to £10,000 a year in pension contributions

- Partial / Phased crystallisation

- How it works: You crystallise portions of your pot over time, taking 25% of each portion tax-free and leaving the rest invested in drawdown.

- Pros:

- Tax efficiency — you only crystallise what you need, spreading tax-free cash and taxable income over multiple years

- Helps manage income tax bands

- Keeps some funds uncrystallised, allowing more future tax-free lump sums

- Cons:

- More administration

- Market risk on uncrystallised funds and funds in remaining in drawdown

- UFPLS (Uncrystallised Funds Pension Lump Sum)

- How it works: Instead of drawdown, you take lump sums directly from uncrystallised funds. Each withdrawal: 25% tax-free, 75% taxed as income

- Pros:

- Simple — no need to move into a separate drawdown account

- Flexibility to “dip in” as needed

- Cons:

- Each withdrawal is partly taxable, so less control than phased crystallisation

- Can trigger the MPAA

- May run out faster without investment growth

-

Tax-free Cash Only (No Income Yet)

Tax-free Cash Only (No Income Yet)

- How it works: Crystallise part or all of your pot just to take the 25% lump sum, but leave the taxable portion invested in drawdown. You don’t actually draw income yet

- Pros:

- Access cash without immediately paying income tax

- Keeps taxable funds invested for later

- Cons:

- Growth is now on crystallised funds (no new tax-free cash generated)

- May still affect Lifetime Allowance tests if relevant (though the LTA is being replaced with lump sum allowances)

- Staged Annuity Purchase

- How it works: You crystallise parts of your pot over time to buy annuities in stages

- Pros:

- Hedge against poor timing — you can buy annuities when rates are better

- Provides guaranteed income

- Cons:

- Irreversible

- Less flexibility than drawdown

- Blend of Drawdown + UFPLS + Annuity

- How it works: Many retirees mix strategies. For example, take phased crystallisation to manage tax-free cash, use UFPLS for ad hoc needs, and later buy an annuity for guaranteed income

- Pros:

- Tailored to income needs and tax planning

- Balances flexibility with security

- Cons:

- More complex

- Requires ongoing review

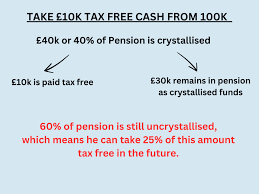

Example (simplified, £100k pot)

- Full crystallisation: £25k tax-free lump sum, £75k to drawdown/annuity.

- Phased crystallisation (25% now): £25k crystallised → £6.25k tax-free, £18.75k to drawdown. Remaining £75k uncrystallised, so more tax-free cash available later.

- UFPLS (£10k withdrawal): £2.5k tax-free, £7.5k taxed as income.

In practice, most people don’t stick rigidly to one — they phase crystallisation to control tax and inheritance planning, then may annuitise part of the pot later for secure income

Leave a reply

You must be logged in to post a comment.