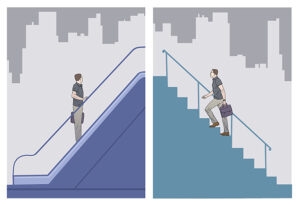

Are you active or passive?

Investing in the financial markets has been a popular way to grow wealth for decades. However, there are two main schools of thought when it comes to how to approach it: active and passive investing. Each strategy has its own set of principles, advantages, and drawbacks

NMTBP explains the key differences between the two so that you can decide which approach aligns better with your financial goals and risk tolerance

Active Investing: The Art of Stock-Picking

Active investing involves hands-on management of your investment portfolio. In this approach, investors aim to outperform the market by selecting specific shares or other assets they believe will perform better than the broader market. This often involves in-depth research, analysis, and decision-making. Active investors are typically more engaged in their investment decisions and tend to monitor their portfolio frequently

Key characteristics of active investing include:

Stock Selection: Active investors spend time researching individual stocks, industries, or asset classes. They rely on various strategies, such as fundamental analysis, technical analysis, and market timing, to make their investment decisions

Higher Costs: Active investing usually incurs higher costs due to frequent trading, research expenses, and management fees for actively managed funds or advisors

Potential for Higher Returns: The goal of active investing is to achieve superior returns by capitalising on market inefficiencies and making well-timed investments

Higher Risk: While active investing offers the potential for higher returns, it also comes with increased risk. Wrong investment decisions or market timing can lead to substantial losses

Emotional Involvement: Active investors often face emotional challenges when their investments underperform, or market conditions become turbulent

Passive Investing: A Steady and Diversified Approach

Passive Investing: A Steady and Diversified Approach

Passive investing, on the other hand, is a strategy based on the belief that it’s challenging to consistently beat the market over the long term. Instead, passive investors seek to replicate the performance of a particular market index or asset class by investing in a diversified portfolio of assets. This approach involves minimal trading and often lower costs

Key characteristics of passive investing include:

Index Funds and ETFs: Passive investors often use index funds or exchange-traded funds (ETFs) that track a specific market index, such as the S&P 500, rather than individual stocks

Lower Costs: Passive investing typically has lower costs due to reduced trading activity and lower management fees for index funds and ETFs

Market Average Returns: The primary objective of passive investing is to match the returns of the chosen index, which are considered representative of the overall market’s performance

Lower Risk: Passive investors often have a more diversified portfolio, reducing the risk associated with individual stock or asset selection

Reduced Emotional Stress: Passive investing minimises the need for frequent trading and decision-making, reducing emotional involvement and stress

Choosing the Right Strategy for You

The decision between active and passive investing ultimately depends on your financial goals, risk tolerance, time commitment, and expertise. Here are some considerations to help you choose the right strategy:

Time and Expertise: Are you willing and able to dedicate significant time to research and manage your investments actively, or do you prefer a more hands-off approach?

Risk Tolerance: How comfortable are you with the idea of potentially underperforming the market or facing higher risk in pursuit of potentially higher returns?

Costs: Consider your budget and how much you’re willing to pay in fees, as active investing tends to be costlier

Diversification: Are you confident in your ability to select individual assets, or do you prefer a diversified portfolio that minimises single-stock risk?

Long-Term vs. Short-Term Goals: Are you investing for long-term wealth accumulation or short-term gains? Your investment horizon can influence your strategy

Emotional Resilience: Can you handle the emotional challenges that come with active investing, including periods of underperformance and market volatility?

Businessman concept, Active or Passive road to the correct way.

Of course, there’s nothing to stop you from choosing a hybrid approach, blending active and passive strategies to balance your portfolio’s risk and reward profile. Regardless of your choice, it’s crucial to continually monitor and adjust your investment strategy to align with your evolving financial goals and changing market conditions

To sum up, the active vs. passive investing debate is not about determining which approach is superior; rather, it’s about identifying the strategy that suits your own individual circumstances and financial objectives. Each strategy has its own merits, and the key to successful investing lies in making informed choices based on your unique circumstances and staying committed to your long-term financial goals

Leave a reply

You must be logged in to post a comment.