Number Spoofing: how scammers fake Caller IDs -and how to stay safe

Have you ever received a phone call that looked genuine — maybe from your bank, your GP, or even your own number – only to realise later it was a scam? That trick is called number spoofing, and it’s one of the most common tools fraudsters use in the UK today

It’s quick, it’s convincing, and it’s designed to make you drop your guard. Understanding how it works – and what to do when it happens – can protect you and your money

What is number spoofing?

Number spoofing occurs when criminals falsify the caller ID information displayed on your phone. Instead of showing the real number they’re calling from, they can make it look like a trusted organisation – such as your bank, HMRC, the police, or even a local business

In the days of traditional landlines, caller ID information was automatically transmitted and couldn’t easily be changed. But the shift to digital and internet-based calling (VoIP) has changed that. It’s now relatively easy for scammers to alter the number displayed, even if they’re calling from overseas

Legitimate businesses use caller ID presentation for good reasons — for example, so that all outgoing calls display the company’s main switchboard number. Criminals, however, use the same technology to gain trust and trick people into revealing information or making payments

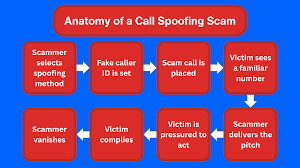

How number spoofing works

When you receive a call, your phone network sends a small data packet to your device that tells it which number to display

In VoIP systems, that field can be edited, and scammers take full advantage

They might:

- Use a local area code so the call looks familiar and you’re more likely to answer (a tactic known as neighbour spoofing)

- Mimic a bank or utility company’s number to make you think the call is official

- Pretend to be a government department, claiming there’s an urgent tax issue or legal matter

Once you pick up, the scammer might claim there’s a problem with your bank account, a missed parcel delivery, or even that you owe money to HMRC. The goal is always the same – to create panic or pressure so you act quickly without thinking

Why number spoofing is so dangerous

Spoofing works because it exploits trust. Most people rely on caller ID to decide whether to answer a call. When the number looks familiar – especially if it matches a real business or government agency — we tend to assume it’s legitimate

Scammers know this. They’ll often use urgent or emotional language:

Scammers know this. They’ll often use urgent or emotional language:

“There’s been fraudulent activity on your account”

“You’ll be arrested if you don’t pay immediately”

“Your parcel can’t be delivered unless you confirm your details”

Even savvy people can be caught off guard, particularly if the spoofed number matches one you’ve seen before on official correspondence or your bank card

In the UK, Ofcom and Action Fraud receive tens of thousands of reports each year about spoofed calls. Losses can range from a few pounds to entire life savings, particularly when victims are persuaded to move money “for security reasons”

Industry’s response: blocking spoofed calls

Telecom regulators and networks have begun fighting back. Ofcom now requires UK phone providers to block calls originating from abroad that pretend to come from UK numbers, unless they can prove the call is genuine

This single measure has already stopped millions of scam calls from ever reaching consumers

Other improvements include:

- Caller ID verification between networks, helping to confirm that the displayed number matches the true origin of the call

- Smarter call-blocking and spam-filtering tools, built into most mobile networks and smartphones

- Ongoing cooperation between Ofcom, the National Cyber Security Centre (NCSC), and law enforcement to track and shut down organised fraud rings

These steps make it harder for criminals to operate – but spoofing hasn’t disappeared. Staying alert is still vital

How to protect yourself

Here are some simple but powerful ways to stay safe from number spoofing and phone scams:

- Don’t trust the number on your screen

Even if the caller ID looks legitimate, it could be fake

If someone claims to be from your bank, HMRC, or the police, hang up and call back using a verified number – one printed on a statement, bank card, or the organisation’s official website

- Never share personal or financial details

Legitimate organisations will never ask for your PIN, full password, or one-time security codes over the phone. If anyone requests them, it’s almost certainly a scam

- Use call-blocking and spam-filtering tools

Most major UK mobile networks – including EE, O2, Three, and Vodafone — now offer free services to block or flag suspected scam calls

You can also install reputable call-blocking apps if your phone doesn’t already have this feature

- Report suspicious calls

Forward scam texts or report suspicious phone numbers to 7726 (which spells “SPAM” on your keypad). It’s free and alerts your mobile provider so they can investigate and block fraudulent numbers

You can also report incidents to Action Fraud (actionfraud.police.uk) or call 0300 123 2040

- Protect your online accounts

Enable multi-factor authentication (MFA) wherever possible. This adds an extra layer of protection in case scammers do manage to obtain some of your personal information

- Talk about it

Many victims, especially older people, feel embarrassed after being tricked — but these scams are extremely sophisticated

Warn friends and family about spoofing tactics so they know what to look for. Awareness is the best defence

The road ahead

Regulation is tightening, and technology is improving, but number spoofing won’t vanish overnight. Criminals are adaptable and quick to exploit loopholes, particularly across international networks

That’s why consumer vigilance remains crucial. Each time you stop and question an unexpected call — and each time you report a suspicious number — you help disrupt the cycle of fraud

Number spoofing is a clever, fast-moving scam that turns a familiar piece of technology – caller ID – into a tool for deception. But a few simple habits can protect you: never trust a number on face value, verify callers independently, and report anything suspicious

Remember: numbers can lie – but a calm, cautious response will always tell the truth

Leave a reply

You must be logged in to post a comment.