Property vs. other asset classes: what you should be thinking about

Property’s always held a special place in the British investor’s heart. From buy-to-let flats to commercial warehouses, bricks and mortar are often seen as a safe bet. But with mortgage approvals hitting nine-month highs, interest rates still elevated, and whispers of new taxes on the horizon, it’s worth asking: is property really the best option for UK investors today? Or do equities, bonds and other assets deserve more of your attention?

NMTBP unpacks the pros, cons and trade-offs

Why property still appeals

- Income and inflation protection: Rental yields can look attractive, and over the long run, property tends to keep pace with inflation. That makes it feel real and tangible compared to numbers on a trading screen

- Diversification: Property doesn’t always move in sync with shares or bonds, so adding it to a portfolio can smooth out the bumps

- Leverage: Mortgages allow you to borrow against property, magnifying returns when markets rise

For many investors, these qualities still make property an appealing foundation in a portfolio

The hidden drawbacks

But property comes with trade-offs that are easy to overlook:

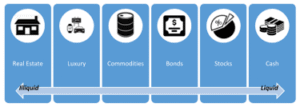

- Liquidity: Unlike shares, you can’t sell a rental flat at the click of a button. Transaction costs are high, and sales can drag on

- Tax and regulation: From stamp duty to capital gains tax, property is heavily taxed. Reliefs for landlords have been scaled back, and there’s political pressure for more changes

- Management burden: Tenants, repairs, compliance -being a landlord is closer to running a small business than holding a passive investment

- Financing risk: Higher mortgage rates have eaten into buy-to-let margins. Unless rates fall meaningfully, leveraged property is far less profitable than it once was

How other assets compare

Equities (shares and funds)

- Historically higher growth potential than property

- More volatile day-to-day, but easier to buy, sell and diversify

- Big tax advantages if held in ISAs or pensions

Bonds

- Provide income and stability, though recent inflation has dented their real returns

- Useful for balancing risk but unlikely to generate the same returns as property or equities over decades

Alternatives (infrastructure, private equity, commodities)

- Offer additional diversification

- Can be accessed through funds if you don’t want the complexity of direct investing

Decision factors to consider

Decision factors to consider

When weighing property against other assets, ask yourself:

- Do I need liquidity? Property ties up capital, while shares and funds can be sold quickly

- Am I investing for growth or income? Property often leans toward steady income, equities toward growth

- How much risk can I take? Equities are volatile; property risks are more about financing costs and regulation

- What about tax? ISAs and pensions make equities highly tax-efficient. Property has fewer shelters

- Do I want hands-on management? If not, property may be more hassle than it’s worth

A balanced approach

For you, the answer isn’t “property or stocks” but “property and stocks.” Property can anchor a portfolio with tangible assets and rental income, while equities provide growth, liquidity and tax efficiency. Bonds and alternatives add further stability

The right mix depends on your horizon, risk tolerance and financial goals. What matters is being clear about what role property plays – and not assuming it’s automatically the safest or most rewarding choice.

What to watch out for

- Interest rates: If borrowing costs fall, property may regain some shine

- The November budget: Any changes to property taxation or landlord regulation could shift the balance further

- Property supply and demand: Especially in residential and logistics, where shortages or growth can drive returns

- Relative valuations: If property yields rise while equity markets look expensive, the opportunity may flip

Property still deserves a place in many UK investors’ portfolios – but gone are the days when it was the obvious winner. With higher financing costs, heavier taxes and more regulation, the margin for error is narrower than ever

The smart move? Treat property as one part of a diversified strategy, keep an eye on policy changes, and always run the numbers carefully. Balance, not blind faith in bricks and mortar, is what will build your wealth going forward

Leave a reply

You must be logged in to post a comment.